Gold has always played an important role in a country’s economic environment. It has been a key component in several countries’ financial reserves for centuries without showing any signs of slowing down any time soon!

Discussions about gold reserves are incomplete without addressing the US dollar. For decades, several countries have been using the USD as their chief reserve currency, influencing inherent monetary policies and international trade.

Gold reserves are often used as an alternative to the US dollar. Central banks resort to holding more gold if they want to reduce their dependency on the dollar. The current state of the economy has prompted banks to increase their gold possessions. This further deepens the bond between the USD and the reason why central banks are buying gold.

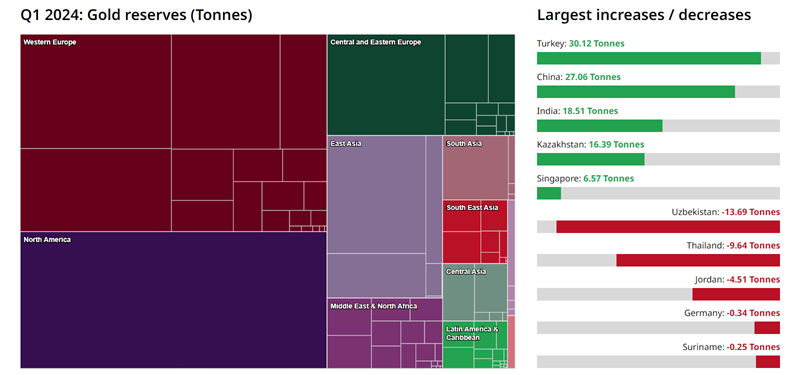

Central banks worldwide hold almost one-fifth of all gold ever mined as reserves. Here is what the shows about the increase/decrease in the gold reserves held by different countries in the first quarter (Q1) of 2024:

Led by Turkey with 30.12 tonnes, the image shows a massive spike in the gold reserves held by major countries. While a few countries have reduced their reserves, the rise in gold reserves clearly overshadows it.

| Country | Region | Gold Reserves Tonnes | Gold Reserves Millions | Holdings % |

|---|---|---|---|---|

| China | East Asia | 2262.45 | 161071.82 | 4.64 |

| Japan | East Asia | 845.97 | 60227.84 | 4.67 |

| Switzerland | Western Europe | 1040 | 69495.46 | 8.04 |

| India | South Asia | 822.09 | 58527.34 | 8.98 |

| Taiwan, China | East Asia | 422.38 | 28224.67 | 4.71 |

| Saudi Arabia | Middle East & North Africa | 323.07 | 21588.22 | 4.71 |

| Hong Kong SAR | East Asia | 2.08 | 139.25 | 0.03 |

| Russian Federation | Central and Eastern Europe | 2332.74 | 166076.25 | 28.14 |

| South Korea | East Asia | 104.45 | 6979.3 | 1.66 |

| Singapore | South East Asia | 236.6 | 16844.74 | 4.45 |

| Brazil | Latin America & Caribbean | 129.65 | 9,230.43 | 2.6 |

| United States of America | North America | 8,133.46 | 5,79,050.15 | 71.33 |

A country’s central bank is responsible for increasing or decreasing its gold reserves. These entities control the money supply and manage the currencies in their respective countries. While central banks always buy gold, the recent trend of increasing gold reserves deserves our attention.

There are multiple reasons why central banks are buying gold. They depend on global economic factors and a country’s domestic economic health.

Here are some of the most common reasons why central banks are buying gold:

One of the biggest reasons why central banks are buying gold is to tackle economic uncertainties. These are the situations wherein a country’s financial future becomes difficult to predict. Instead of taking risks, central banks prefer buying tangible assets like gold to ensure financial stability during turbulent times.

Economic uncertainties can arise due to multiple reasons, including Government policy changes, political instability, market fluctuations, natural disasters, etc. Common examples where countries around the world experienced economic uncertainty include the COVID-19 waves, the collapse of the housing market in 2007-08, Brexit, and many more.

Holding on to a single currency or asset reduces a country’s capacity to navigate economic crises. Buying more gold allows central banks to diversify their reserves. While most countries are already using the US dollar as their chief currency reserve, gold investment reduces excessive dependence on this currency.

Such diversification puts countries in a safe position when it comes to future financial volatility. For example, if de-dollarization (countries choosing currencies other than the USD as their chief reserves) hints at economic uncertainty, having more gold reserves puts a country in a more stable financial position.

Central banks and economists have always seen gold as a great hedge against inflation. When the economic going gets tough for a country, gold often emerges as a savior.

During inflation, the value of currency reduces. However, this has little to no impact on the value of gold. In fact, its value is likely to increase during inflation. This is one of the reasons why gold reserves are used as an alternative to chief currency reserves to tackle economic rough patches like inflation.

During such times, even if a central bank’s purchasing power in terms of currency reserves takes a toll, more gold holdings can offset this loss.

Economic uncertainties often increase during geopolitical tensions. For example, following the Russia-Ukraine conflict, Russia is subject to even more sanctions and limitations, making the country move away from the US dollar as its chief currency reserve. In turn, Russia now uses the Chinese renminbi as its currency reserve.

In other news, the tension between the US and Iran has increased significantly in the wake of the Israel-Hamas war. Such events are bound to make the global economic climate more volatile, increasing the need for safe haven investments like gold.

Central banks of countries also buy more gold as a strategic economic move to get economic leverage. Countries like India, China, and Turkey are lodging some of the highest gold reserve increases. This is because countries with competitive gold reserves have greater influence on international trade, finance, and negotiations.

Many developing countries are also buying more gold to prepare for de-dollarization. If they move away from the US dollar, significant economic uncertainty will leave these countries no option but to make safe bets and increase their investments in tangible assets like gold.

Ultimately, central banks' gold purchases increased during such tensions in geopolitics, market fluctuations, and fear of insatiable economies. Central banks throughout the world began to view gold as a way to broaden their holdings and mitigate risk as confidence began to erode.

A central bank is the barometer of its country’s economic well-being. It takes all important decisions regarding increasing/decreasing gold reserves, choosing a chief currency reserve, and much more. From hedging against inflation and navigating de-dollarization to surviving geopolitical conflicts and making strategic economic moves, different countries have different reasons for buying more gold.

Just like a country’s central bank, its citizens also benefit from investing in tangible assets like bullion gold. If you wish to make such a secure and fruitful investment, BOLD Precious Metals helps you purchase gold coins and bars at the best prices.

Along with buying gold, we’d advise you to stay in tune with the ongoing geopolitical scenario to make informed financial decisions. Always remember: what affects your country’s finances also affects your personal finances!